How to Setup a Business in Dubai as a German Citizen

Table of Contents

TL;DR Summary

- German citizens can set up and fully own a Dubai company in most sectors.

- Your first decision is jurisdiction: mainland for UAE local work, free zone for international or remote models.

- UAE corporate tax exists. It is 9% above AED 375,000 profit. Some free zones can still qualify for 0% on qualifying income if compliant.

- A Dubai company does not cancel German tax by itself. If you stay tax resident in Germany or manage the business from Germany, German tax risk remains.

- Exit tax and residency planning are the big traps. This needs proper structure, not assumptions.

- Residency visas support banking and tax residency paperwork, but only if the relocation is real.

- Banking is strict. Most delays come from unclear activity, a weak source of funds, and poor documentation.

- The biggest mistakes are “invoice from Dubai, live in Germany,” wrong activity selection, and ignoring substance requirements.

Company Setup in Dubai as a German Citizen

Setting up a company in Dubai has become a serious consideration for many German entrepreneurs, freelancers, and investors.

Not only because of tax efficiency, but also because Dubai offers stability, access to global markets, and a regulatory system that actively welcomes foreign investment.

Why Dubai is an Attractive Base for German Entrepreneurs

Dubai is not a tax haven in the traditional sense. It is a structured, regulated business environment with clear rules and strong enforcement. For German citizens, this distinction matters.

The UAE offers 100 percent foreign ownership in most sectors, no personal income tax, no capital gains tax on individuals, and a growing network of double tax treaties. Germany and the UAE have a double taxation agreement, which plays a crucial role in structuring income correctly.

Beyond tax, Dubai offers strategic advantages. It sits between Europe, Asia, and Africa. Flights are direct and frequent. Banking is modern. Infrastructure is reliable. And English is the working language of business.

Most importantly, Dubai allows German founders to scale internationally without relocating clients, suppliers, or operations overnight.

Can a German Citizen Own a Business in Dubai?

Yes. German citizens can fully own a business in Dubai.

The UAE allows 100 percent foreign ownership for most commercial and professional activities. This applies to both mainland and free zone companies. There is no requirement for a local Emirati shareholder in the vast majority of cases.

Ownership restrictions are limited to a small number of strategic sectors such as defense, oil exploration, and certain public utilities. These are not relevant to most German entrepreneurs, consultants, or investors.

What matters more than ownership is control. German authorities look at where decisions are made, not just where the company is registered.

Related Articles:

- Incorporate in Dubai Fast with Trusted Business Consultants

- How to Set Up a Business in Dubai from the UK

- How to Start a Business in Dubai from India

Who this Setup is Not for

Dubai is not the right solution for every German business owner.

It is not suitable for founders who intend to remain fully tax resident in Germany while expecting UAE tax benefits.

It is also not appropriate for businesses with all clients, staff, and decision-making still based in Germany, but with a Dubai company added purely for invoicing.

German tax authorities actively assess substance and management location. Structures without economic reality rarely hold.

Dubai works best when there is a genuine shift in business operations, leadership, or market focus.

Choosing the Right Jurisdiction

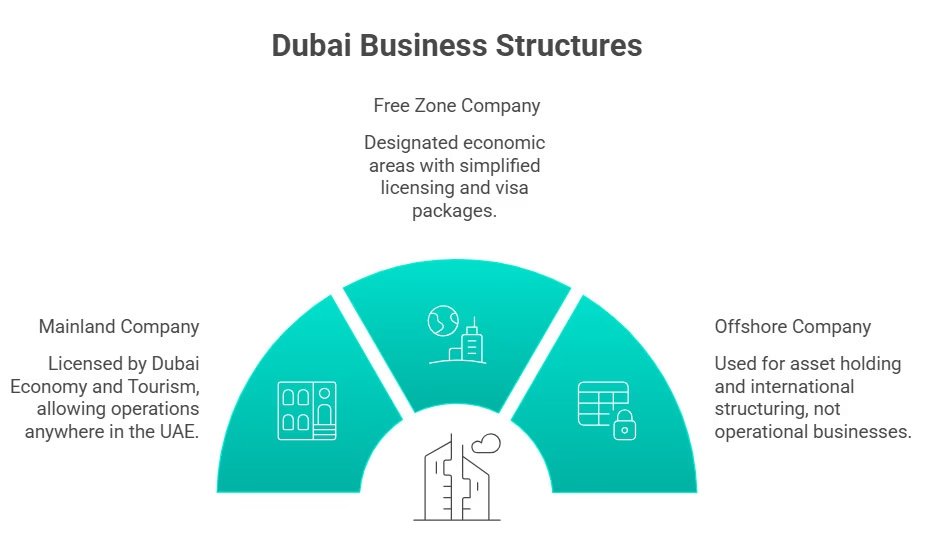

Each jurisdiction offers distinct advantages of business setup in Dubai for German citizens.

Mainland Company

A mainland company is licensed by the Dubai Economy and Tourism. A Dubai mainland license allows you to operate anywhere in the UAE and work directly with government entities and local clients.

This structure is suitable for German entrepreneurs who plan to open offices, hire staff locally, or conduct on-ground operations in Dubai.

Mainland companies now allow 100 percent foreign ownership for most activities. A local service agent may still be required for certain professional licenses, but they hold no equity and no control.

Free Zone Company

Free zones are designated economic areas with their own authorities. They are popular with German consultants, digital businesses, holding companies, and international traders.

Dubai free zone business setup allows full foreign ownership, simplified licensing, and often bundled visa packages. However, direct trading within the UAE mainland may require a local distributor or additional approvals.

Free zones are ideal if your clients are outside the UAE or if your operations are largely remote.

Offshore Company

Offshore entities are not designed for operational businesses. They are used for asset holding, international structuring, or intellectual property ownership.

German citizens typically use offshore companies as part of a broader international structure, not as a standalone operating business in Dubai.

Selecting the Correct Business Activity

Your business activity defines everything that follows. Licensing cost. Visa eligibility. Banking approval. Tax treatment.

Dubai uses a regulated activity list. Each company must select activities that accurately reflect its real operations. Overly broad or mismatched activities create problems later, especially during bank compliance reviews.

German entrepreneurs commonly register activities such as management consulting, IT services, software development, trading, e-commerce, marketing services, and holding structures.

Accuracy matters more than ambition at this stage.

You might be interested in reading more about UAE Foundations vs Holding Companies for Property Ownership.

Understanding Corporate Tax in the UAE

Since June 2023, the UAE has applied corporate tax.

This does not mean Dubai is no longer tax-efficient. It means it is transparent.

Corporate tax is set at 9 percent on net profits exceeding AED 375,000. Profits below this threshold are taxed at zero percent.

Many free zone companies can still qualify for a zero percent corporate tax rate on qualifying income, provided they meet substance and compliance requirements.

For German citizens, this is critical. Proper structuring ensures that profits are taxed in the UAE and not attributed back to Germany.

German Exit Tax and Residency Considerations

This is where most online articles oversimplify.

Germany applies exit taxation rules when a taxpayer gives up German tax residency while holding significant business assets. This can trigger a deemed disposal of shares.

However, the exit tax does not apply automatically. It depends on shareholding percentage, asset type, and timing.

To benefit from Dubai’s tax system, a German citizen must establish genuine tax residency in the UAE. This includes physical presence, residential ties, and economic substance.

Simply owning a Dubai company while remaining a tax resident in Germany does not eliminate German tax obligations.

Professional tax planning is essential at this stage.

Visa and Residency Options for German Citizens

A Dubai business license allows German founders to apply for UAE residency.

The most common options include the standard investor visa linked to company ownership and the long-term Golden Visa for qualifying investors and entrepreneurs.

Residency enables access to banking, leasing property, and applying for a UAE tax residency certificate.

Maintaining residency requires compliance with minimum stay requirements, depending on visa type.

Setting Up in Dubai as a German Freelancer or Consultant

Dubai has become a preferred base for German freelancers and independent consultants working in fields such as IT, marketing, advisory services, design, and digital strategy.

For German freelancers relocating to Dubai, the setup process focuses on three elements. A professional business license, a valid residency visa, and a clear shift of tax residency from Germany to the UAE. Without all three aligned, German tax exposure may continue.

Most freelancers operate through a free zone structure, which offers simplified licensing and lower setup costs. However, the real determinant of success is not the license type. It is whether the freelancer genuinely relocates decision-making, client management, and daily work activities to Dubai.

When structured correctly, Dubai allows German freelancers to operate internationally with reduced tax friction and full regulatory compliance.

You might be interested in reading about the Dubai Freelance Visa.

Germany–UAE Double Tax Treaty Explained for Entrepreneurs

Germany and the United Arab Emirates have an active double taxation agreement designed to prevent the same income from being taxed twice.

For German entrepreneurs, the treaty becomes relevant once tax residency shifts to the UAE. It helps determine where business profits, dividends, and personal income should be taxed.

However, the treaty does not override domestic tax rules automatically. German authorities still examine where management and control are exercised, whether a permanent establishment exists, and whether income has sufficient economic substance in the UAE.

In practice, the treaty works best when supported by proper residency, substance, and governance. Used correctly, it provides clarity and predictability. Used incorrectly, it offers no protection.

Opening a Corporate Bank Account

Banking is often the most sensitive step.

UAE banks conduct strict compliance checks, especially for foreign-owned companies. German nationals are generally viewed as low risk, but documentation must be precise.

Banks assess business activity, source of funds, expected transaction volumes, and international exposure.

A well-prepared application significantly reduces delays.

EZONE can help you with opening a corporate bank account in Dubai.

Ongoing Compliance and Reporting

Running a Dubai company is not a set-and-forget exercise.

Companies must renew licenses annually, maintain proper accounting records, and comply with corporate tax filings.

Substance matters. Especially for free zone entities claiming tax benefits.

German entrepreneurs should view compliance as protection, not paperwork.

Common Mistakes German Entrepreneurs Make

Most problems are not caused by UAE regulations. They are caused by assumptions carried over from Germany.

Common mistakes include:

- Setting up a Dubai company in Dubai while remaining fully tax resident in Germany and assuming foreign incorporation alone changes tax exposure.

- Managing a Dubai company from Germany, which can trigger permanent establishment or management and control issues.

- Selecting business activities that do not reflect actual operations creates problems during banking reviews and compliance checks.

- Underestimating economic substance requirements, even for consulting, digital, or remote businesses.

- Treating Dubai as a short-term workaround instead of a long-term business base.

How EZONE Supports German Citizens

EZONE works with German entrepreneurs who value structure, clarity, and long-term positioning.

We support German founders at every stage of their business setup process, from selecting the correct jurisdiction and activity to handling licensing, visas, and bank coordination.

More importantly, we design setups that stand up to scrutiny. This includes working alongside German and international tax advisors to ensure your Dubai structure aligns with German exit tax rules, permanent establishment considerations, and corporate governance expectations.

Final Thoughts

Setting up a business in Dubai as a German citizen is not about escaping tax. It is about choosing the right system. The UAE offers transparency, predictability, and global access. Germany offers structure and enforcement.

When both are respected, Dubai becomes a powerful base for international growth.

FAQs for German Citizens

Yes. But tax outcomes depend on where management and control take place. If strategic decisions are made from Dubai, German tax authorities may still assess parts of the business. Proper restructuring is often required.

Yes. Many German professionals relocate consulting, IT, marketing, and advisory services to Dubai. The key is aligning visa status, business activity, and tax residency correctly.

VAT applies only if the business supplies taxable goods or services within the UAE and exceeds the registration threshold. Many international service providers are not required to register.

It depends. Dividend treatment depends on residency status, treaty application, and company structure. This requires individual assessment.

EZONE specialize in creating content that highlights business setup and consultancy services. We provide expert insights on company formation, licensing, and the latest industry developments. Through this blog, we aim to equip entrepreneurs and businesses with the knowledge they need to navigate opportunities and challenges in today's market.