UAE Free Zone offers numerous benefits to businesses, such as 100% foreign ownership, favorable tax rates, and simplified company setup procedures. For ambitious business owners, expansion is a natural next step for a successful enterprise. Venturing into new areas helps market growth and taps into untapped client bases. This begs the question: can a UAE Free Zone company operate on the Mainland?

Sanya Hassan

Business Setup Advisor

24 July 2024

Can a UAE Free Zone Company Operate on the Mainland?

To make sense of this, you have to understand the legalities behind making such a move. According to the addendum of 2021 to the UAE Federal Law No. 2 of 2015 (Commercial Companies Law), free zone companies are primarily permitted to operate within their designated free zones. Despite this, some clauses enable Free Zone companies to execute business transactions on the Mainland under certain circumstances. Here’s a closer look at what the law says:

Basics of Operating a UAE Free Zone Company on the Mainland

1. Appointing a Local Distributor or Service Agent:

Free zone companies can appoint a local distributor or service agent to conduct business activities in the mainland. Article 10 of the addendum of 2021 to the Commercial Companies Law mentions this arrangement, which allows companies to engage in trade without the need for a mainland license.

2. Opening a Branch in the Mainland:

Another option is to open a branch office in the mainland. The branch must obtain the necessary licenses from the Department of Economic Tourism (DET) in the relevant emirate. Article 314 of the addendum of 2021 to the Commercial Companies Law states that branches of foreign companies, including those from free zones, can operate in the mainland provided they adhere to the regulatory requirements.

3. No Objection Certificates (NOC) for UAE Free Zone Companies:

Certain free zones provide No Objection Certificates (NOC) that permit their companies to operate outside the free zone. For example, Sharjah Publishing City (SPC) and Meydan Free Zone offer NOCs that facilitate business activities in the mainland.

4. Dual Licensing:

Some free zones also allow dual licensing, enabling companies to operate in both the free zone and the mainland. This arrangement provides greater flexibility and access to a wider market.

Understanding the Mainland

Making the move to the Mainland opens up a much larger customer base and new business opportunities, offering flexibility in business activities and partnerships that can foster closer relationships with various businesses and government entities. A Mainland presence also boosts credibility and trust with clients who prefer dealing with locally based companies. However, transitioning requires careful thought, as it comes with adapting to rules and regulations of the Mainland and costs additions in business setup, including licensing, tax compliance, office space, etc.

Practical Considerations before Operating on the Mainland

While free zones are generally intended for conducting business within their designated areas, with other free zones, and outside the UAE, service companies often find it challenging to determine where their services were rendered. In practice, operating from a free zone entity is more common for service companies, as the nature of their work often crosses geographical boundaries.

While free zone companies enjoy numerous benefits within their designated areas, the UAE’s legal framework provides viable pathways for them to operate in the mainland. By understanding and adhering to the regulations, businesses can effectively expand their operations and tap into the vast opportunities available in the UAE mainland.

At EZONE, we specialize in helping businesses navigate these complexities and find the best solutions for their unique needs. If you’re considering expanding your free zone company into the mainland, our team of experts is here to guide you every step of the way.

To learn more about how we can assist you in achieving your business goals contact us at 800 EZONEUAE (39663823) or e-mail us at hello@e.zone

FAQs about operating a UAE Free Zone Company on the Mainland

A free zone is a designated area in a country that offers special economic regulations and incentives to attract foreign investment and promote business activity.

A wide range of business activities can be conducted in a free zone, including trading, manufacturing, consultancy, media, and logistics.

UAE free zone offers benefits of 100% foreign ownership, tax exemptions, easy setup, access to world-class infrastructure, strategic locations, combination of different business activity groups and a supportive business environment.

The UAE mainland is the area under UAE government jurisdiction, excluding free zones. Businesses here follow federal laws and regulations, allowing them to trade locally and internationally.

It offers benefits like direct local market access, no visa limitations, a broader range of business activities, flexible office locations, and opportunities to participate in government projects and tenders inaccessible to free zone companies.

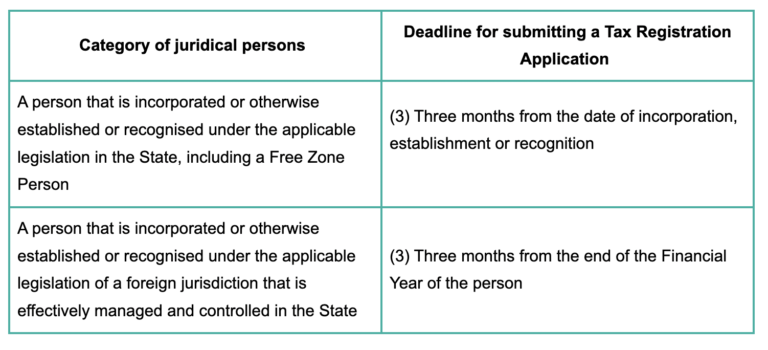

Mainland companies in the UAE are subject to a corporate tax rate of 9% on taxable profits exceeding AED 375,000, while profits up to that threshold are exempt from taxation.

Yes, the UAE offers several visa options for business owners, including investor visas, partner visas, and the Golden Visa, which provides long-term residency for investors, entrepreneurs, and talented individuals.